Westbrooke Alternative Asset Management and Firmament complete investment in e-commerce shipping platform and multi-carrier shipping software provider ParcelHero

Westbrooke Alternative Asset Management, a UK, USA and South Africa-based multi-asset, multi-strategy manager of alternative investment funds and products, announced today its investment in ParcelHero Group Ltd. (or “ParcelHero”), a leading e-commerce shipping platform and provider of multi-carrier shipping software to enterprises and consumers, offering domestic and international shipping options via the largest selection of carrier partners in the United Kingdom. Firmament, a leading provider of tailored capital solutions to small and medium-sized enterprises (SMEs) partnered with Westbrooke as a co-investor in the transaction.

ParcelHero’s technology allows businesses of all sizes to optimize shipping expenses and automate previously analog logistics processes. This significant investment will help fund the ongoing development of the leading B2C software platform and a new B2B capability, which will enable retailers to manage multiple carrier relationships through a single platform.

ParcelHero is led by founder and industry veteran, Roger Sumner Rivers, who possesses 25 years of relevant experience in the logistics technology space. Mr. Sumner Rivers shared his thoughts on the investment, “We are delighted to have Westbrooke and Firmament alongside us as we finalise development of what we believe is a truly differentiated and market leading carrier management platform, releasing to retailers in Q1 ‘22. Both parties are experienced in working with logistics technology businesses and will be great partners to ParcelHero in the future.”

James Stirling, Principal at Westbrooke UK, remarked, “We are really excited to partner with ParcelHero. In line with our core focus of providing flexible funding solutions to privately-owned UK businesses, our team worked very quickly to get this deal across the line. We hope that this transaction will support ParcelHero in their continued growth across the UK and abroad ”

Financial terms of the transaction were not disclosed. ParcelHero was advised by Alantra, led by Robert Young and Irwin Mitchell, led by Akhil Sharma. Firmament was advised by Osborne Clarke led by Hugh Jones.

About ParcelHero

ParcelHero (www.parcelhero.com) provides multi-carrier shipping software solutions to enterprises and consumers across the United Kingdom. ParcelHero is the only parcel delivery comparison site in the U.K. to have domestic and international shipping agreements with all major couriers, enabling them to offer a diverse range of parcel shipment options to its customers.

About Westbrooke

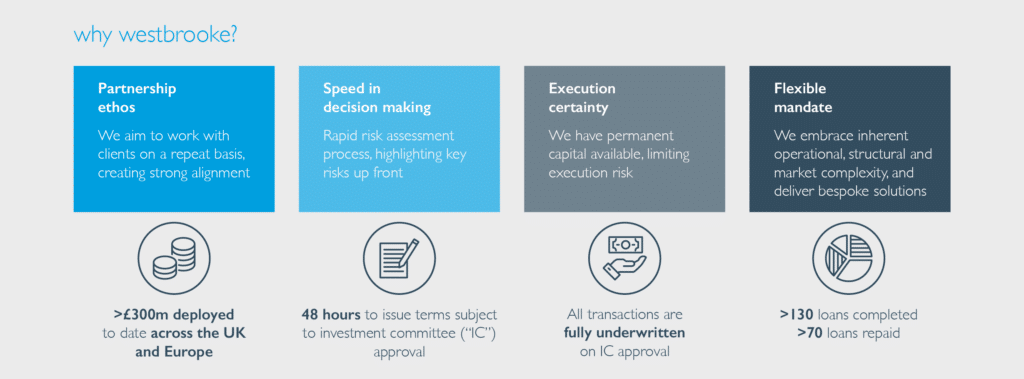

Founded in 2004, Westbrooke was established as a multi-asset, multi-strategy manager of alternative investment funds and products. Westbrooke invests and manages capital in multiple geographies on behalf of its shareholders and investors in private equity, venture capital, private debt, hybrid equity and real estate.

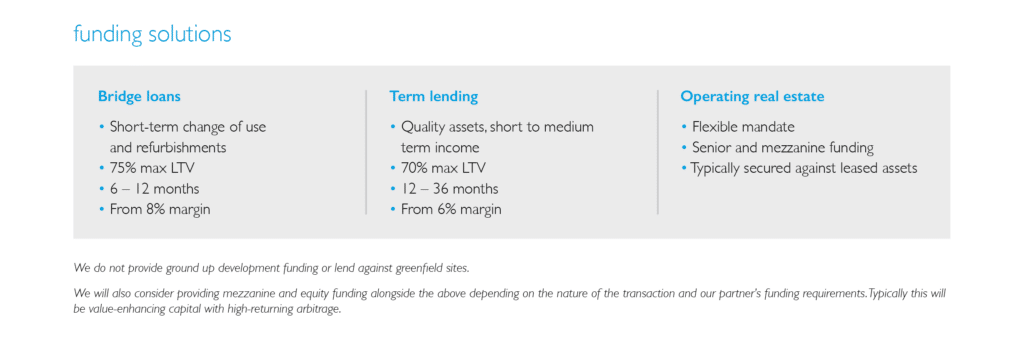

In the U.K., Westbrooke builds strong relationships with entrepreneurs, management teams and private equity houses, providing flexible and agile financing solutions to growing companies with EBITDAs between £1M – £10M. Westbrooke focuses on providing intermediate capital and preferred equity on either a standalone basis or as part of an integrated finance structure, tailored to each client’s needs.

About Firmament

Firmament (www.thefirmamentgroup.com) provides tailored capital solutions to small- and medium-sized enterprises. Firmament is a value-added partner to entrepreneurs, management teams and business owners and curates solutions by deploying versatile capital in a user-friendly way. Firmament concentrates on software and services businesses with significant scaling potential in the healthcare, logistics, wellness and environmental sectors. With offices across the United States and in the United Kingdom, Firmament is focused on turning small business into big business.