Founded in 2004, and with offices in South Africa, the UK and the USA, Westbrooke is a multi-asset, multi-strategy manager of alternative investment funds and co-investment platforms. Our purpose is to preserve and compound our clients’ wealth to cement their future prosperity.

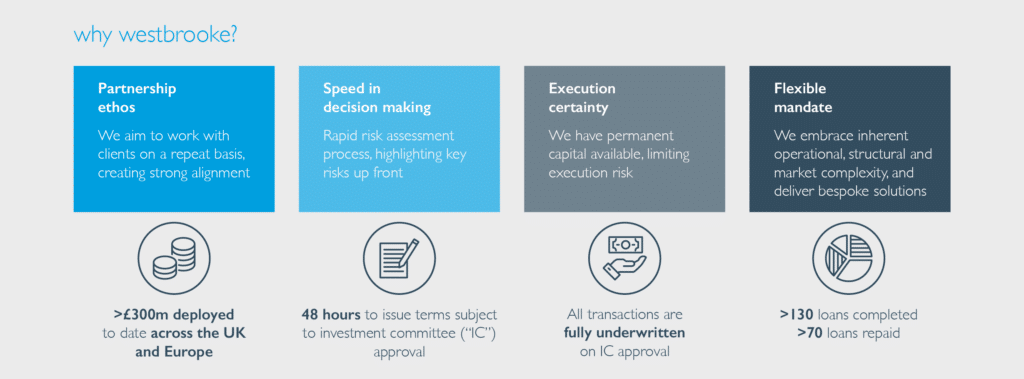

why westbrooke?

A team of highly experienced professionals with decades of investment experience

Core investment philosophy focused on the preservation of investor capital and compounding returns

Heritage as a shareholder and operator of assets

Financial alignment – invested materially alongside our clients and partners

Providing a unique gateway to alternative investment opportunities which are traditionally difficult to access

why alternative investments?

Since alternatives are generally uncorrelated to typical equity and bond investments, investing in them as a core component of a portfolio may provide broader diversification, reduce risk, reduce volatility and enhance returns.

latest news

stay in the know

Complete your details below to sign up for the latest Westbrooke investment local & offshore news & opportunities!