By: Sasha Planting Source: Moneyweb

A small group of Grand Parade shareholders succeeds in getting two out of four proposed directors appointed to the board.

Former judge of the Cape High Court, Alex Abercrombie has been a non-executive director of Grand Parade Investments for 21-years and he has no intention of taking efforts to remove him as a director lying down.

At the GPI special general shareholder’s meeting, which was originally held on October 31, 2018 and was adjourned until December 5, he defended the board in a speech worthy of any closing argument.

He reminded the few shareholders present that their shares had effectively cost them 17c/share, and that they had benefited from dividends worth R184/share, which means the founding investors effectively “own shares you have paid nothing for”.

Yes, the share price has declined and some poor decisions have been made. “Look at Woolworths, MTN, Pick n Pay and Spur. All of these companies have declining share prices,” he said. “I do not deny that the decision to roll out Dunkin’ Donuts and Baskin-Robbins was not a good one as they came too soon after Burger King.

“But look at other corporate decisions; Woolworths’ decision to invest in Australia has cost it billions. I don’t see shareholders lining up there to remove the board.”

The general meeting was called at the request of a group of shareholders who collectively hold 12% of GPI shares. They have flagged a number of concerns related to the company’s performance, as well as the independence of the board and have proposed four non-executive directors to replace the incumbents on the board.

However, Abercrombie argues that board members have dispensed with their duties with skill. “My contribution is my oversight of the gaming business, my legal input and my strategic oversight of the company. None of the proposed new directors have these skills.

“We have not failed in corporate governance. This is nothing more than a hostile takeover aimed at taking over the board, following which, the executive directors would be dispensed with.”

As it turned out Abercrombie survived the vote by a slim margin, with 52.8% of shareholders voting against his removal from the board. Walter Geach and lead independent director Norman Maharaj, survived by a similar margin. Not so lucky were Rasheed Hargey and Nombeko Mlambo, who were voted off the board.

Of the four directors proposed by the ‘dissenting shareholders’ two were appointed to the board as non-executive directors. They are Mark Bowman, former head of SAB Africa and Ronel van Dijk, former CFO of Spur Corporation.

In what looks a bit like a shareholder compromise, the new board members will work alongside the executive leadership team which comprises Hassen Adams, executive chairman; Prabashinee Moodley, CEO; Colin Priem, CFO, and Mohsin Tajbhai, who was announced as an executive director effective November 28. While no reason was given for the appointment of Tajbhai, it may be as a substitute for Adams who is reportedly ill.

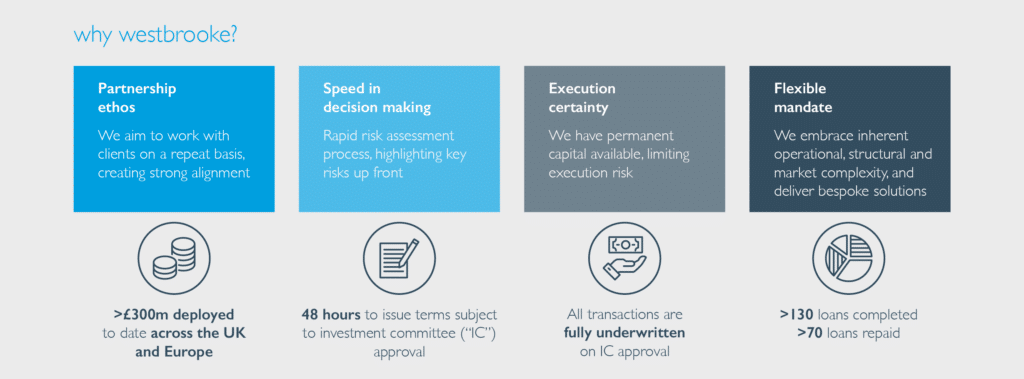

Speaking on behalf of the dissenting shareholders, Jarred Winer, a fund manager at Westbrooke Alternative Asset Management, noted that the outcome was positive. “You have two new high-quality people on the board. I think they can be effective. I think the voting also shows that the shareholder voice – both institutional and individual – can be larger than you think.”

The GPI AGM will be held next week where shareholders have the opportunity to quiz management and vote on a number of resolutions.

The offbeat comment from baseball legend Yoggi Berra “It ain’t over ‘till its over” seems apt at this point.