Westbrooke Alternative Asset Management is pleased to announce the closing of a R65 million senior secured debt facility to Enable Capital. The funding will further accelerate Enable’s impressive growth to date.

Enable Capital is a market leading provider of funding solutions to subcontractors and contractors in the fibre industry. Enable, through their proprietary technology and platform, provides innovative financing solutions to subcontractors by way of an invoice discounting facility alleviating cash flow pressures.

Brent Blankfield, Fund Manager in Westbrooke’s South African private debt business said “We are thrilled to be a partner to the Enable team. We believe that Enable, through their deep industry knowledge and proprietary technology, are well positioned to grow and capitalise on a high growth sector within South Africa. This investment is another example of Westbrooke’s expertise in providing innovative, flexible capital solutions to market leading speciality finance companies.”

Hano Coetser, CEO and Co-Founder of Enable Capital said “We are very excited to work with Westbrooke and build a long term, mutually beneficial relationship that will deliver real social and economic impact. The capital injection from Westbrooke will contribute to the next phase of the fibre industry where modern infrastructure is being rolled out to peri-urban, township and rural areas. This will have a long-lasting impact on these communities and the economy as a whole.”

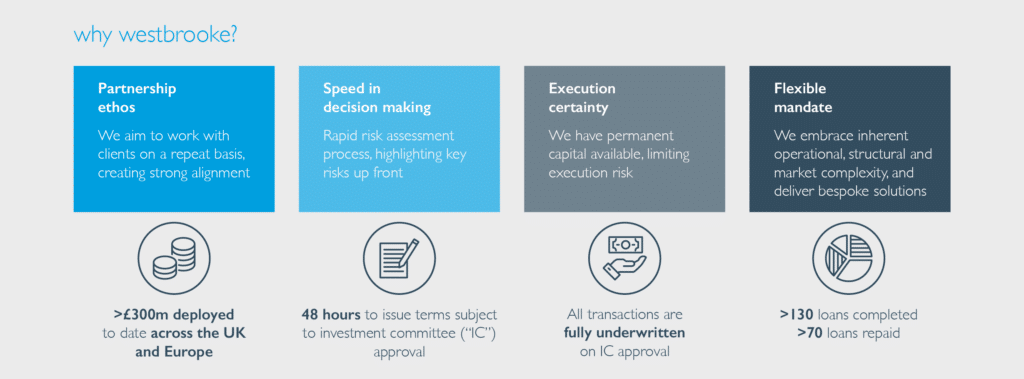

Westbrooke Alternative Asset Management was established as a multi-asset, multi-strategy manager of alternative investment funds and products structured to preserve and compound our clients’ wealth to cement their future prosperity.

With offices in South Africa, the UK and the USA, Westbrooke invests and manages capital on behalf of our shareholders and investors in Private Debt, Hybrid Capital, Real Estate, Private Equity and Venture Capital. We manage in excess of R8bn of shareholder and investor capital invested predominantly in SA, the UK and the USA. Westbrooke’s SA private debt business is a leading provider of innovative and flexible capital solutions to South African lower and middle market companies and entrepreneurs. We invest in and provide solutions across the capital structure in a quick, flexible and entrepreneurial way to support our partners growth and needs. Westbrooke invests across asset classes and sectors, including real estate, speciality finance companies, investment holding companies and operating companies, amongst others.